Take the coin flips you are confident about — the art of risk management

After understanding the importance of returns compared to expectations, it is natural to talk about risk. There is no return without risk, so an understanding of how to minimize risks is essential in business and increasingly so.

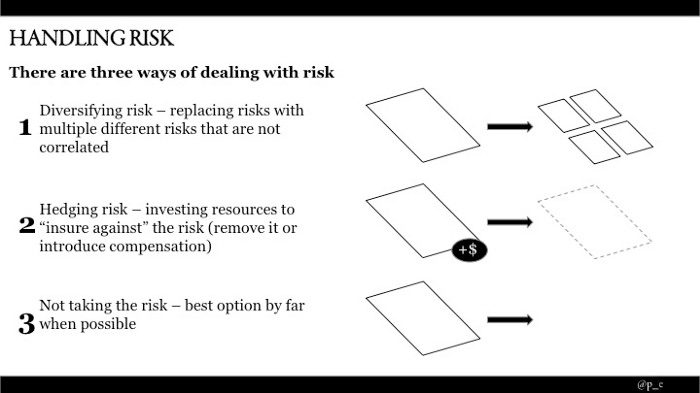

There are three main ways of dealing with risk and we go through them in turn.

1. Diversifying risk

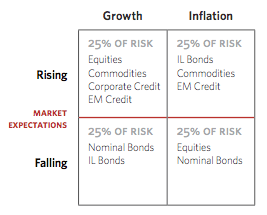

Often a risk can be replaced with multiple smaller risks that are independent, meaning that one negative event doesn't necessarily trigger any other. In his All Weather paper, Ray Dalio used the strategy to develop a more resilient portfolio strategy. He started by recognizing there were four types of market stress situations, each one of them represented a risk to certain classes of assets in the portfolio.

He chose asset types so that risk in the portfolio was evenly divided across these four scenarios, making sure that only 25% of the portfolio is exposed in any given scenario.

As a result, back testing revealed the portfolio to out-perform (on a risk-adjusted basis) other diversified asset allocations while severely limiting yearly losses.

There was a weak point in the strategy, however, not all these scenarios are incompatible. In particular, low equity returns, low bond returns and a low inflation return shuts out equities, bonds and nominal bonds, resulting in significant exposure. This is exactly where we find ourselves today with the fund losing 7%.

2. Hedging risk

In the same way that individuals insure against various personal risks, corporations can insure against risks through transferring risks, buying assets that are anti-correlated, investing in mitigation/ contingency solutions, etc. For example, this strategy allows oil producers to reserve the right to sell at a certain price.

3. Not taking the risk

Sometimes when I know that I don’t know which way the coin is going to flip, I try to position myself so that it won’t have an impact on me either way. In other words, I don’t make an inadvertent bet. I try to limit my bets to the limited number of things I am confident in. ~Ray Dalio, Principles

Own only your natural risks

There are economies of scale in owning particular classes of large risks as well as valuable expertise to be gathered. That is why insurance companies can effectively hedge individuals or companies against specific risks. Ideally, a business should have a competitive advantage in any significant risk they are taking. Betting your company on regulation is tough. Betting your company on your ability to establish a platform change in your space is a risk that is more often matched with an appropriate reward.

The biggest risk is the risk of not knowing

The Black Swan introduced the idea that the most dangerous risks, “tail risks” are ones so rare, we are simply not aware of them. Ray Dalio agrees: “I remained wary about being overconfident, and I figured out how to effectively deal with my not knowing. I dealt with my not knowing by either continuing to gather information until I reached the point that I could be confident or by eliminating my exposure to the risks of not knowing.”