Risk parity

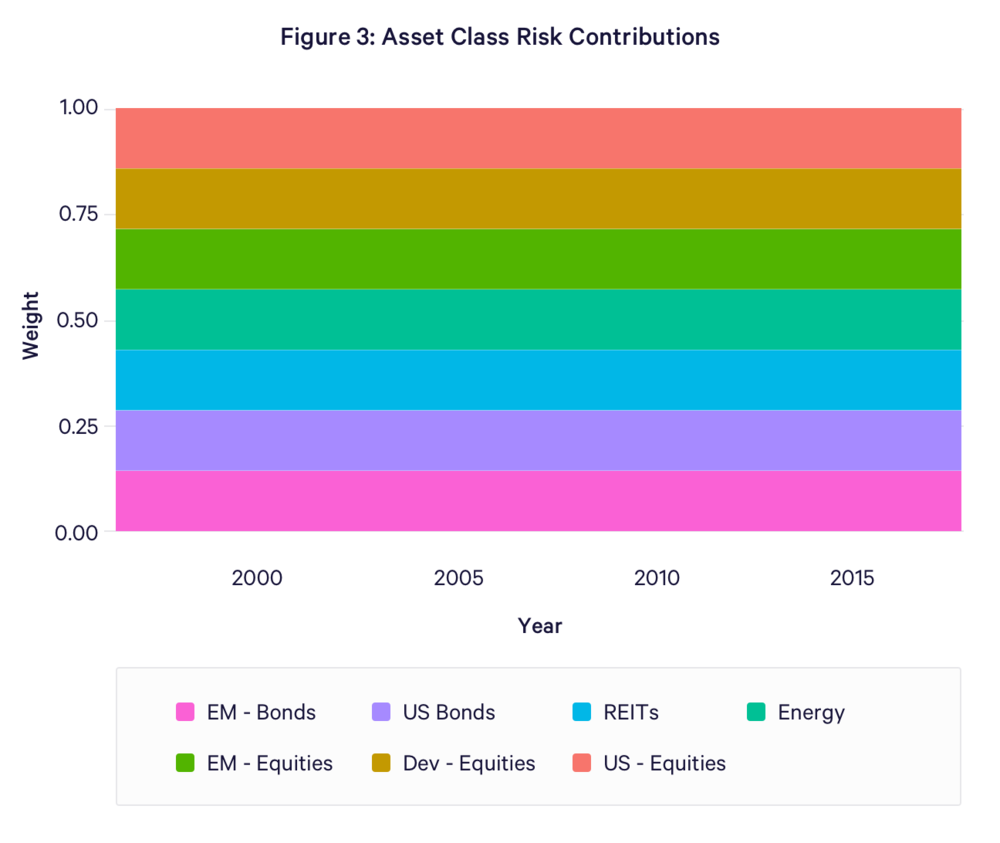

Risk parity is an improvement over traditional diversification methods. It allocates assets so that different asset types have equal overall risk exposure influenced both by allocation weight and volatility.

Illustratively, imagine you have to allocate $1,000 across stocks & bonds. We're also given that stocks are 2x more volatile than the bonds. Traditional diversification would advocate buying $500 worth of stocks and $500 worth of bonds - a 50-50% split. However, according to risk parity, we should buy $667 worth of bonds and only $333 worth of stocks. Risk parity research merits that this new allocation will have the optimal risk-return characteristics of any allocation.

Q: Do returns of the individual asset classes matter in this model?

A: Risk is more important than returns in this model, but it's important that volatile assets have higher returns and less volatile assets have smaller returns.

Q: Wouldn't this portfolio have a lower overall return?

A: Yes, a portfolio can have a better risk-adjusted return but lower overall return. To increase the absolute return of a risk parity portfolio, all asset classes are leveraged.

Q: Are there any implicit assumptions in risk parity?

A: A recent paper by JPMorgan called Improving on Risk Parity suggests that risk parity implicitly assumes equal Sharpe ratios (risk-adjusted returns) across asset classes. They also think these will change going forward and in that case risk parity would under-weigh better performing assets.

Risk parity can also be applied recursively within an asset class.

References

Bridgewater All Weather Strategy

Related

Wealthfront