MicroStrategy ($MSTR) is a very expensive way to own Bitcoin

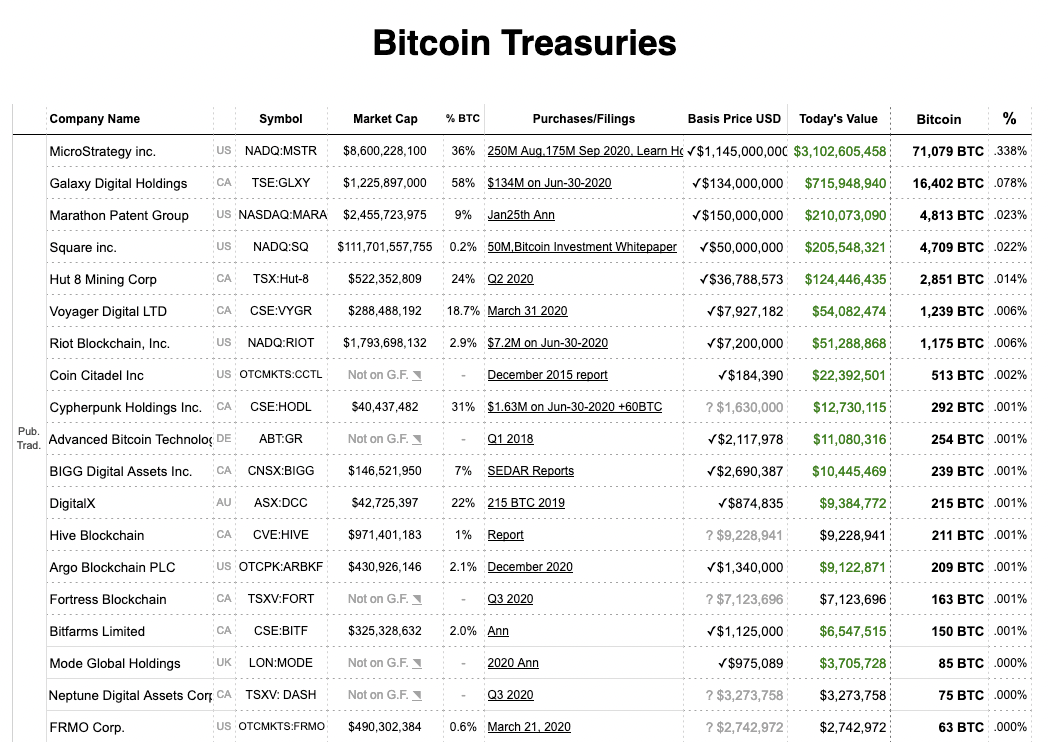

A number of companies have recently started assembling Bitcoin treasuries. There are two good websites for tracking these purchases. MicroStrategy currently has the largest known Bitcoin reserve (71,079 BTC) with 36% of the market cap attributed to the market value of their Bitcoin reserve.

They recently started to dabble in Bitcoin advocacy, hosting several sessions and introducing ~6900 companies to their process for acquiring Bitcoin. If they succeed, expect the list to get a lot longer.

But why would someone pay $10 to own $3.6 in BTC?

For one, it's hard to access Bitcoin in tax efficient vehicles such as the UK's ISA accounts. Certain companies are also limited from taking on too much Bitcoin custody risk. And yes, some market participants could simply be speculating that MicroStrategy will be priced even higher due to its unique treasury strategy.

The idea is simple, $6.4 of each $10 purchase goes towards MicroStrategy's business. The business hopefully stays relatively stable and the rest of the purchase will be allocated to the BTC treasury.

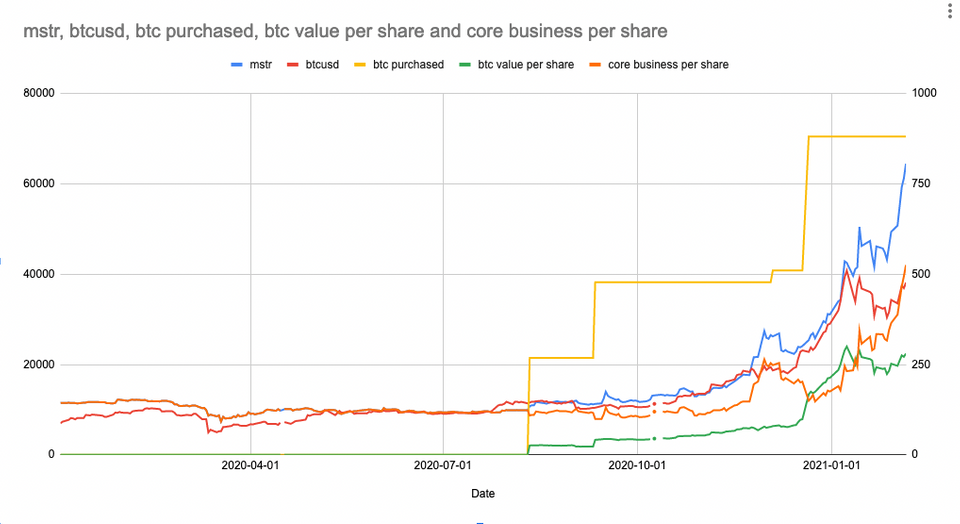

But while MicroStrategy's business is in a stable decline, the implied premium on their core business is much higher than I expected. In the chart above, the orange line indicates the implied price per each share that goes to the core business. From just over $100 earlier the year, it has now jumped to over $500, a 5x premium on the value of a falling business with no other ideas for investing excess cashflow. It may have been a good idea to invest in 2020. Not so much today.

So while it's an expensive way to buy BTC, Michael Saylor's comments in their quarterly filings suggest another reason to buy.

Going forward, we continue to plan to hold our bitcoin and invest additional excess cash flows in bitcoin. Additionally, we will explore various approaches to acquire additional bitcoin as part of our overall corporate strategy.

The entire point of owning MicroStrategy is to outsource not just BTC ownership but BTC purchasing to Michael Saylor. It's the intent to buy even more BTC that has made MicroStrategy the leading Bitcoin treasury owner.

The premium may just pay for the promise that Michael Saylor together with Coinbase can identify better timing on when to make those purchases. Indeed, as an individual investor, it is trivial to purchase BTC at current prices, but substantial acquisitions by larger companies move the market and have to be carefully timed. For those companies, MicroStrategy can serve as a temporary holding point before they are able to build up their own position.

Disclaimer

This is not investment advice.